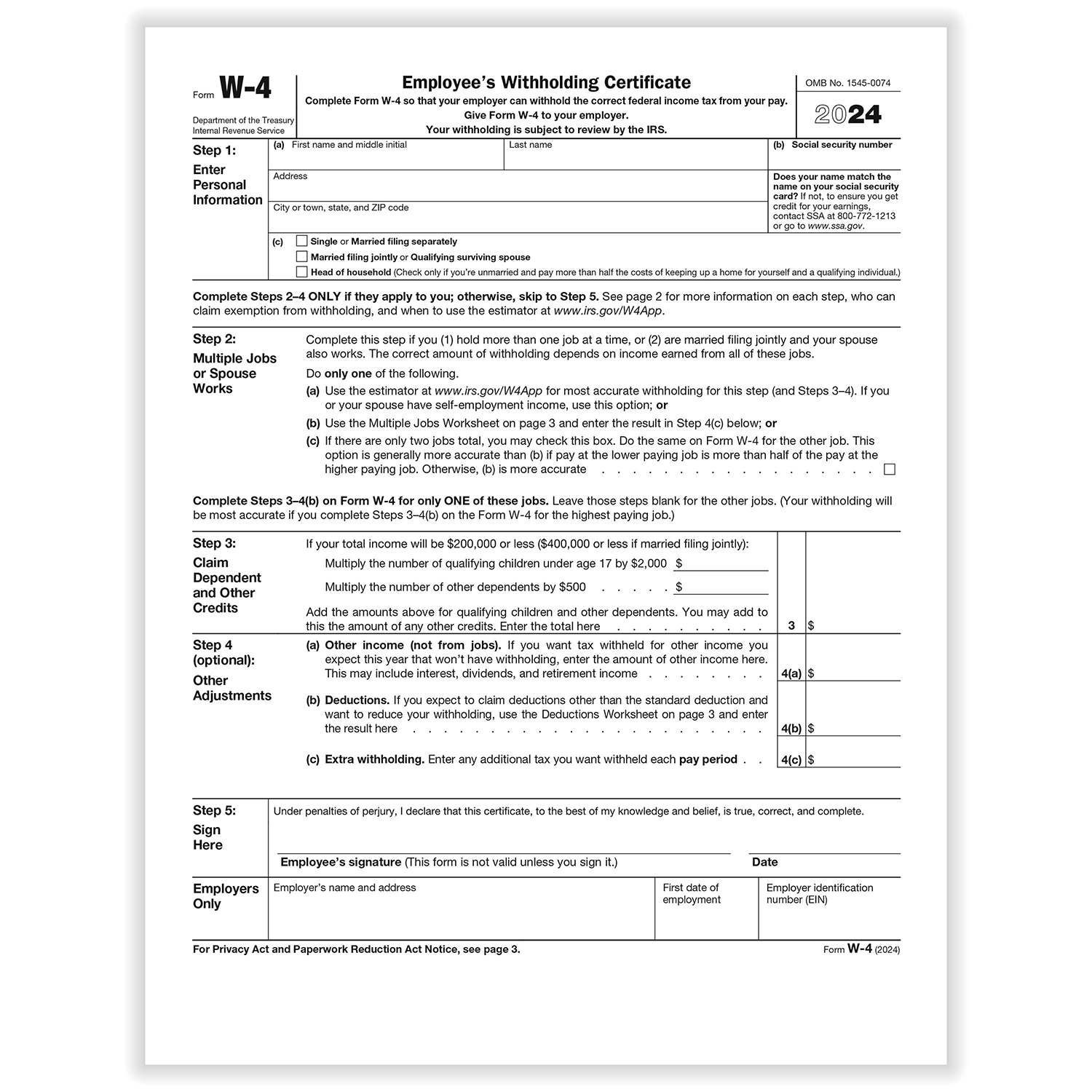

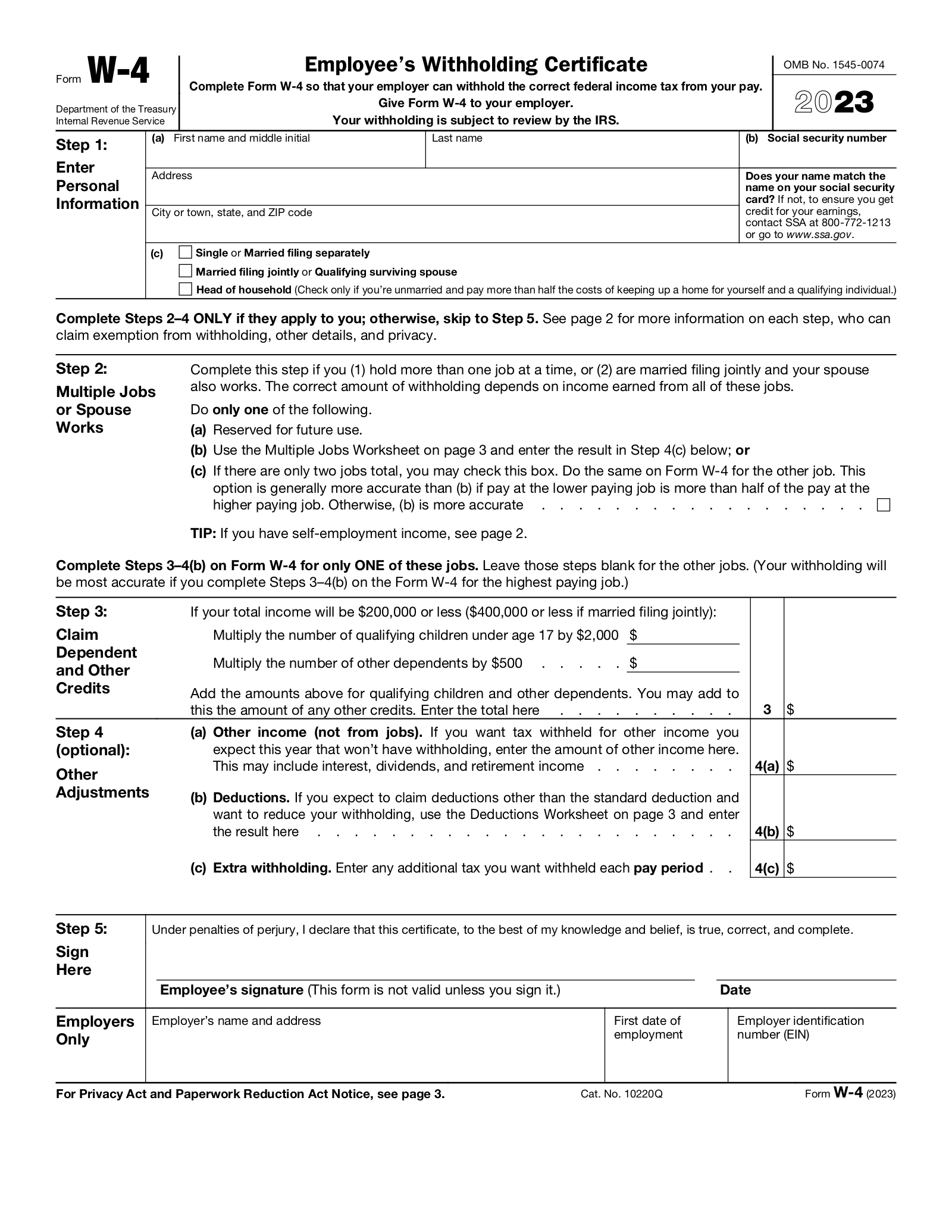

Irs 2024 Form 2024 Printable – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

Irs 2024 Form 2024 Printable

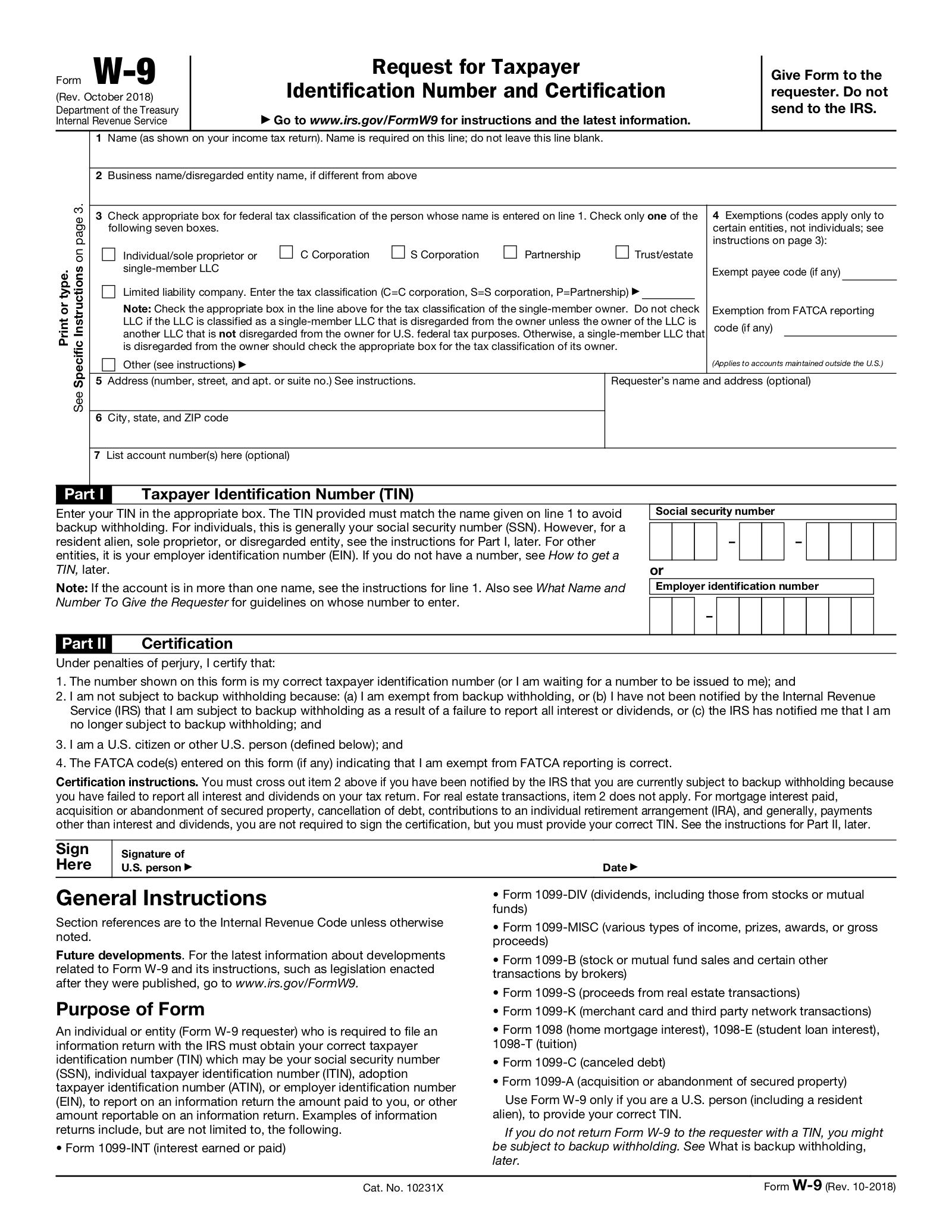

Source : www.wolterskluwer.comFree IRS Form W9 (2024) PDF – eForms

Source : eforms.com2024 Form W 4P

Source : www.irs.gov2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comEmployee’s Withholding Certificate

Source : www.irs.govPrintable IRS Tax Forms for 2023, 2024: Simplifying Tax Season

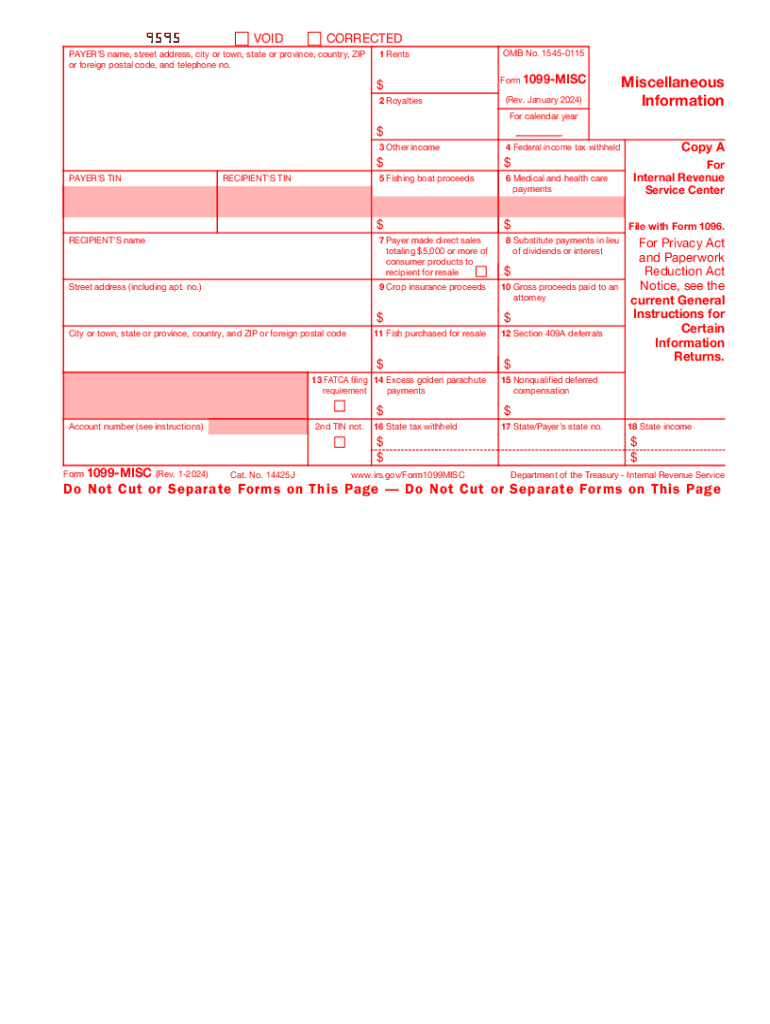

Source : fox59.com2024 Form IRS 1099 MISC Fill Online, Printable, Fillable, Blank

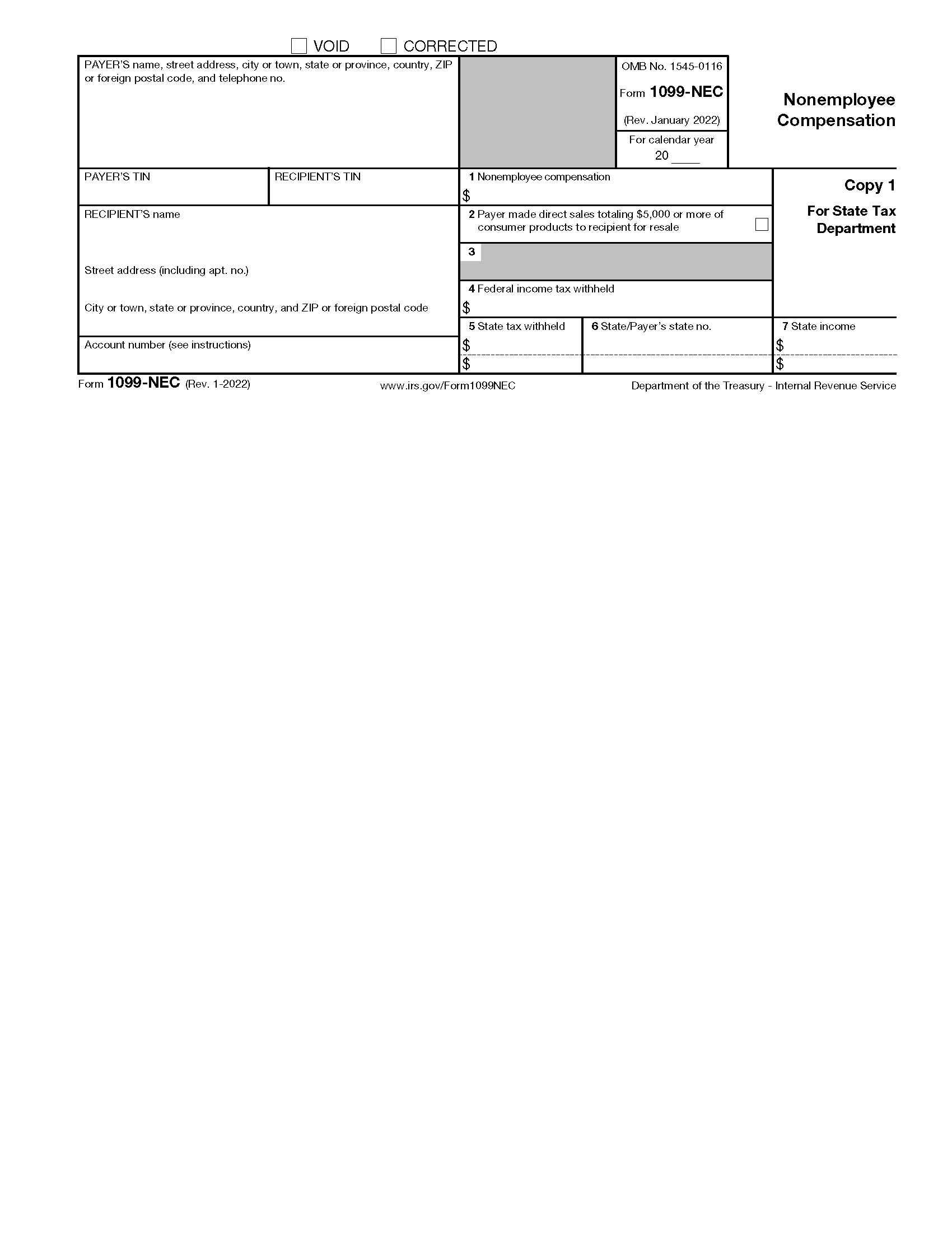

Source : 1099-misc-form.pdffiller.comFree IRS 1099 NEC Form (2021 2024) PDF – eForms

Source : eforms.comW9 Form 2024 W9 Form 2024

Source : w9form2024.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comIrs 2024 Form 2024 Printable IRS Releases 2024 Form W 4R | Wolters Kluwer: As of 2024, employers and employees more throughout the year. The FUTA tax rate is 6% on the first $7,000 in income. After an employee surpasses $7,000 in income, the employer can stop paying FUTA . Not all Free File offers include free state returns, so make sure to read the fine print Free Edition supports Form 1040 and limited tax credits only. Most tax software providers offer a free .

]]>