Are Business Meals 100% Deductible In 2024 – If not, the meal included as part of the entertainment “When you think about business deductions, a 100% deduction is a very common thing,” Luscombe said. Even the purchase of capital . During the pandemic, for the calendar years of 2021 and 2022, business owners were temporarily allowed to deduct 100% of the cost of work-related meals and beverages at restaurants. That provision .

Are Business Meals 100% Deductible In 2024

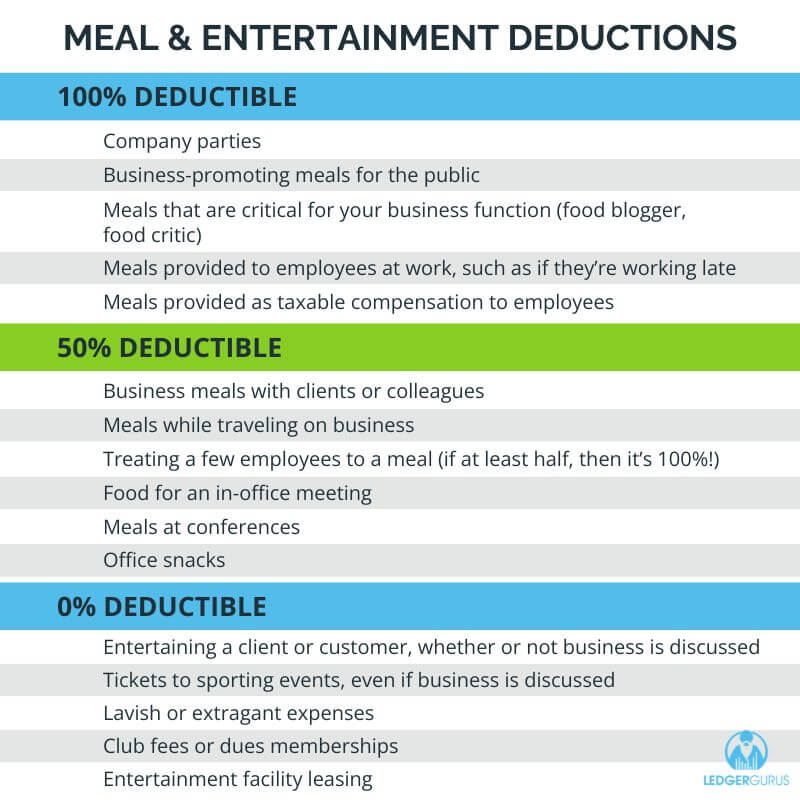

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2024

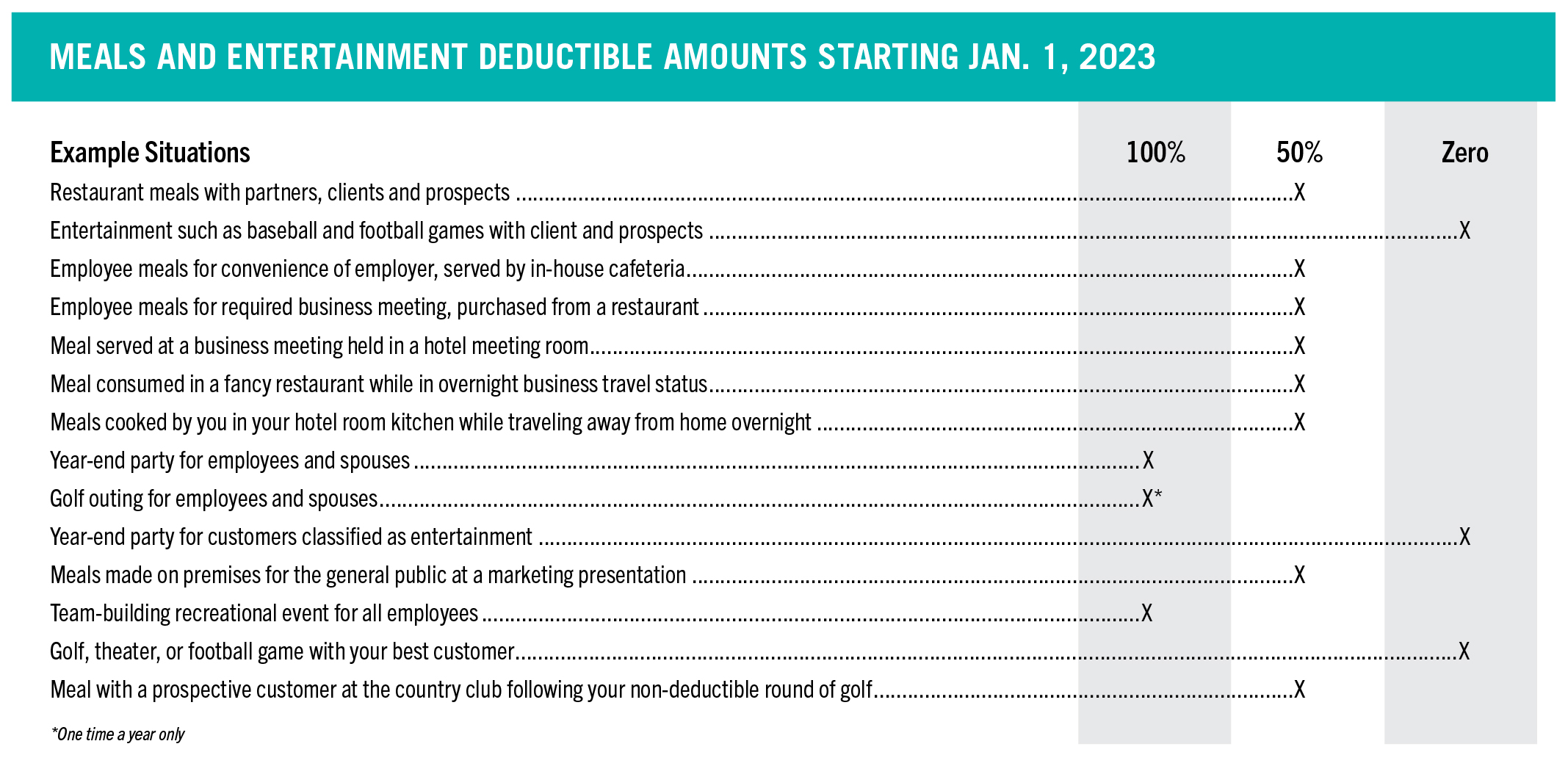

Source : www.bench.coMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.com100% Deduction for Business Meals in 2021 and 2022 Alloy Silverstein

Source : alloysilverstein.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comNova Financials, LLC | London KY

Source : www.facebook.comTax Changes for Your 2023 Filing and a Brand New 2024 Reporting

Source : lslcpas.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comAre Business Meals 100% Deductible In 2024 Meal and Entertainment Deductions for 2023 2024: This tax season, the IRS said it’s adding staff and technology to “reverse the historic low audit rates” on high-income taxpayers. Filing season can already be a stressful time for many people, with . In addition to fully deducting business meals that would normally be 50% deductible, businesses will be able to claim travel expenses as well. This change will not impact your tax return for 2020, .

]]>